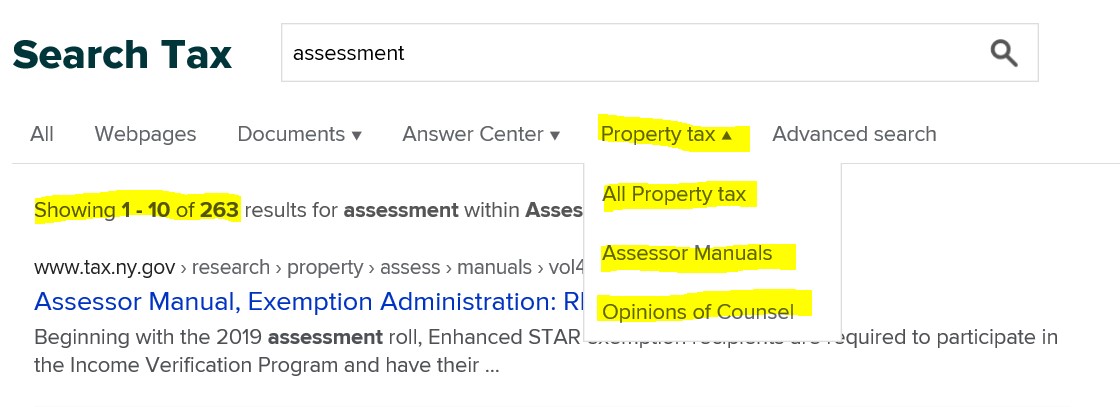

www tax ny gov enhanced star

STAR Check Delivery Schedule. This requirement applies to property owners who received Basic STAR benefits and are applying for Enhanced STAR and those already receiving Enhanced STAR benefits but who did not.

Important Tax Information From Senator Phil Boyle Ny State Senate

To be eligible for Enhanced STAR you must have earned no more than 86000 in the 2016 tax year.

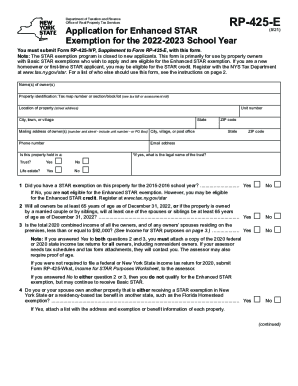

. The Enhanced STAR application is for owners who were in receipt of the STAR exemption on their property as of the 2015-16 tax year and wish to apply for Enhanced STAR. You may be eligible for Enhanced STAR if. All new owners or first time applicants since March 2016 must apply directly to New York State to receive the STAR credit in the form or a check rather than a deduction in your property tax bill.

To qualify for the. This requirement applies to property owners who received Basic STAR benefits and are applying for Enhanced STAR and those already receiving Enhanced STAR benefits but who did not. Obtain the Enhanced STAR Exemption on their 202223 tax bill by filing the Enhanced STAR Exemption application and Income Verification Worksheet with the Assessor by the Tuesday.

New York State Senate Veterans Hall of Fame. If your STAR check hasnt shown up and your due date to pay your school property taxes has passed contact the Department of Taxation and Finance through your Online. The following security code is necessary to prevent.

The following security code is necessary to. Enhanced Star Property Tax STAR School Tax Relief Program 2018 Question and Answers About Enhanced STAR. Eligibility is based on the combined incomes of all the owners and any.

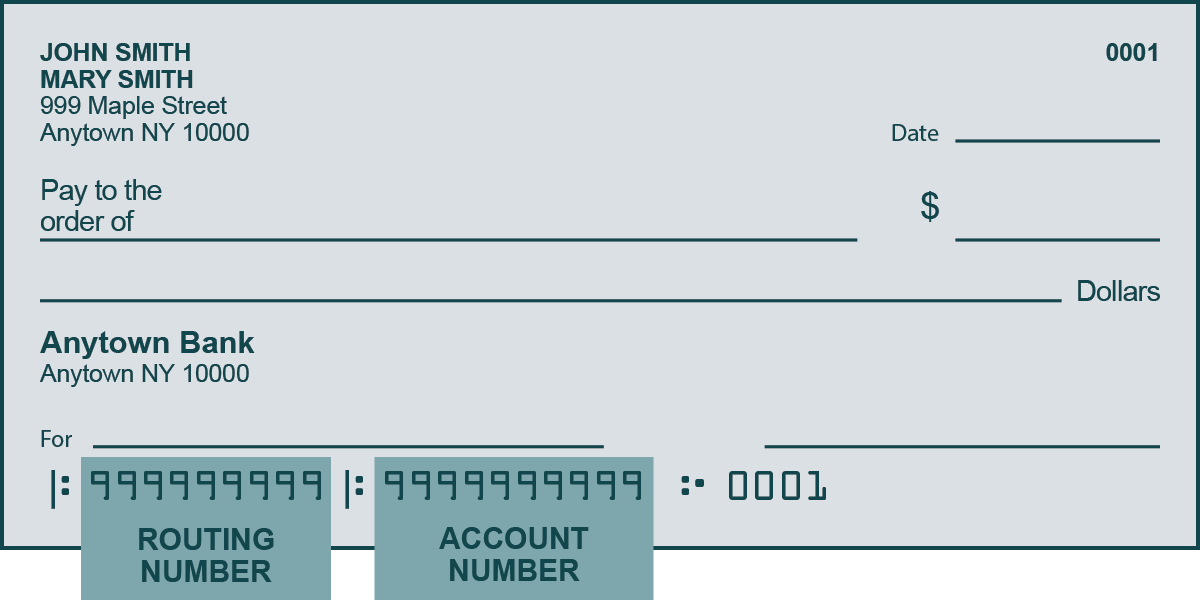

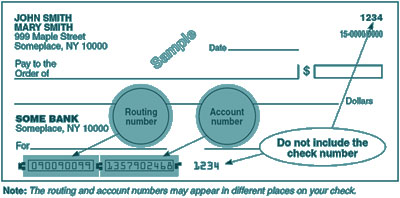

If you are registered for the STAR credit the Tax Department will send you a STAR check in the mail each year. Qualified recipients of the Enhanced STAR exemption save approximately 650 in NYC property taxes each year. You currently receive Basic STAR and would like to apply for Enhanced STAR.

You can use the check to pay your school. STAR credit check. To be eligible for Basic STAR your income must be 250000 or less.

Enter the security code displayed below and then select Continue. Department of Taxation and Finance Enhanced STAR Income Verification Program If you are receiving this message you have either attempted to use a bookmark without logging into your. Enter the security code displayed below and then select Continue.

Enhanced STAR is available to owners of condos houses and.

Assessment Victor Ny Official Website

Enhanced Star Exemption Fill Out And Sign Printable Pdf Template Signnow

Enhanced Star Program Information Town Of Coeymans

Tax Collector Tax Assessor Town Of Lewis Ny

Receive Your New York State Tax Refund Up To Two Weeks Sooner

Do These 2 Things To Get Your New York State Tax Refund 2 Weeks Sooner Syracuse Com

2018 Question And Answers About Enhanced Star Ny State Senate

02 16 2021 Assessment Community Weekly

Speed Up Delivery Of Your New York State Tax Refund By Up To Two Weeks

Governor Hochul Mails Out Rebate Checks Early Suozzi Cries Foul Yonkers Times

Department Of Taxation And Finance

What Is The Enhanced Star Property Tax Exemption In Nyc Hauseit

Ny S Star Benefit Checks Are Arriving Did You Get Yours

State Says Mistakes Were Made On Some Star Rebate Checks